- 4B - 48, Fourth Floor, High Street - Highland Corporate Center, Kapurbawadi, Thane (w) 400607

- info@niveshkaro.com

Want to know and save more for your investments, dream home, child’s education, retirement, travel adventures, or a secure future? Tax planning is your key to keeping more of your hard-earned money while staying compliant. In 2025, with tax-saving investments gaining traction, smart planning is a must for every Indian taxpayer. NiveshKaro.com, India’s trusted zero-commission platform, connects you with expert local tax consultants to craft the best tax-saving plans in India. Don’t let tax deadlines sneak up—act now to maximize savings!

What are Tax Filing & Tax Planning?

Tax Filing is the process of submitting your income tax return (ITR) to the government, reporting income and taxes paid. Tax Planning involves strategically using deductions, exemptions, and investments to minimize tax liability while aligning with financial goals. It’s essential for residents of Mumbai, Pune, or Nashik aiming for financial freedom.

Types of Tax Filing

• ITR-1 (Sahaj): For salaried individuals with income up to Rs.50 lakh.

• ITR-2: For those with capital gains or multiple income sources.

• ITR-3: For professionals or businesses with complex income.

• ITR-4 (Sugam): For presumptive business or small earners.

Why is Tax Planning & Filing Important?

Tax planning reduces your tax burden, freeing up funds for life goals. Filing ITR on time avoids penalties (Rs.5,000–Rs.10,000) and ensures compliance. In 2025, with rising incomes and tax scrutiny, it’s vital for:

• Young Professionals: Save for future milestones.

• Families: Fund education or travel.

• Seniors: Secure retirement income.

Act Fast: Tax deadlines are looming—start planning today!

Benefits of Tax Planning & Filing

• Maximize Savings: Deductions up to Rs.1.5 lakh under Section 80C.

• Avoid Penalties: Timely filing prevents fines and legal hassles.

• Financial Growth: Redirect savings to investments like ELSS or PPF.

• Loan Eligibility: ITRs boost creditworthiness for loans.

• Peace of Mind: Stay stress-free with compliance.

Documents Required

• PAN & Aadhaar: For identity verification.

• Form 16: Salary and TDS details from employers.

• Bank Statements: For interest income or deductions.

• Investment Proofs: ELSS, PPF, or insurance receipts.

• Capital Gains Records: For property or stock sales.

Tax-Saving Strategies

• Section 80C: Invest in ELSS, PPF, or NSC for up to Rs.1.5 lakh savings.

• Section 80D: Claim health insurance premiums (Rs.25,000–Rs.75,000).

• NPS: Save Rs.50,000 extra under Section 80CCD(1B).

• HRA: Optimize rent deductions for salaried employees.

• Long-Term Investments: Use bonds or fixed deposits for stable returns.

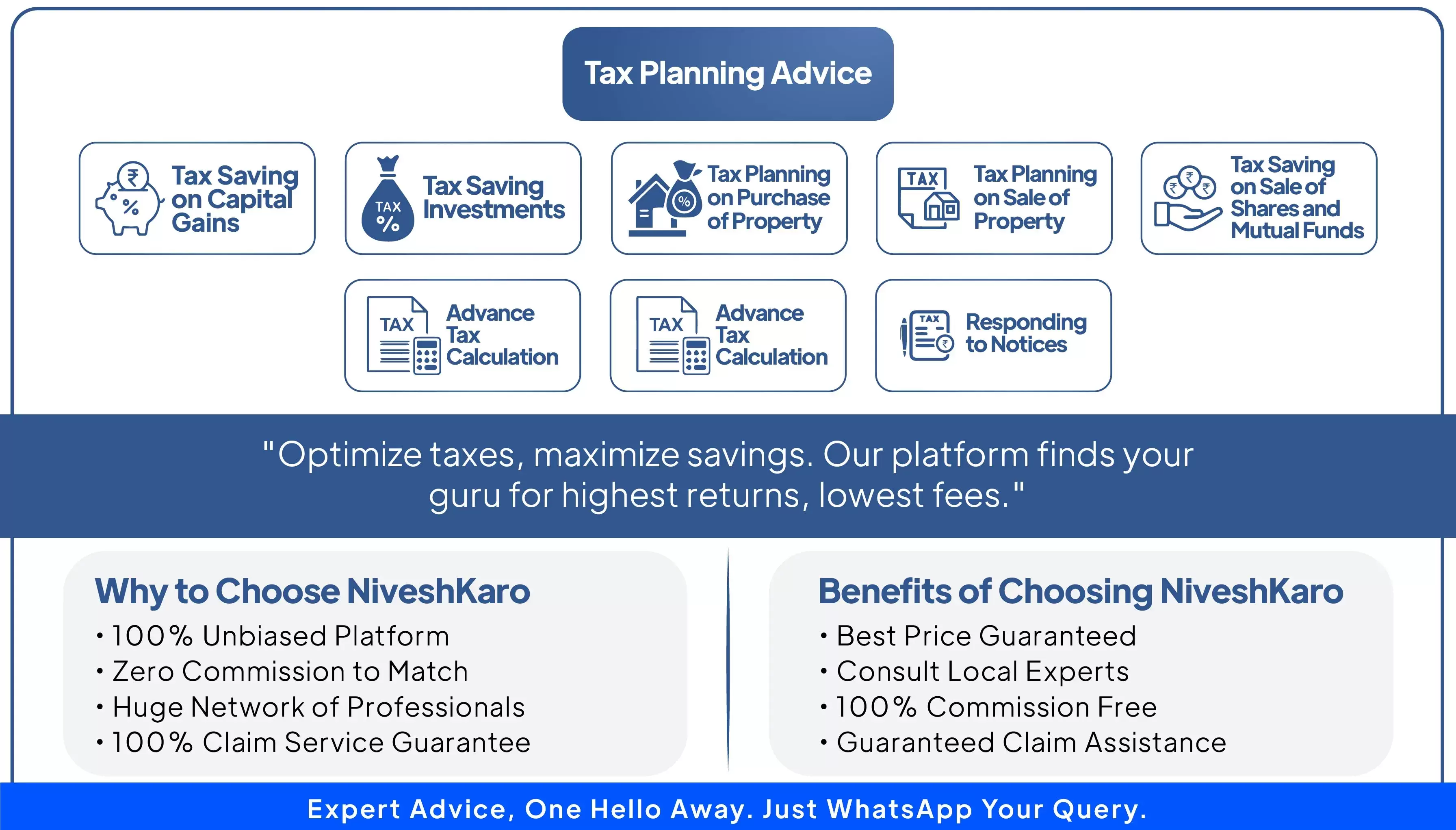

Why Choose NiveshKaro.com’s Local Tax Consultants?

NiveshKaro.com connects you with certified, authorized tax consultants and CAs from top firms, ensuring unbiased, need-based tax plans—not what consultants push to sell. They offer in-person guidance, low-cost filing and advisory services, and tools like ITR e-filing at India’s best rates. With zero commissions and real-time tax updates, you stay compliant and informed.

Benefits of Using NiveshKaro.com

• 100% Free Service: No fees, ever.

• Independent Advice: No firm bias, just your goals.

• Local Expertise: Tax consultants in Mumbai, Pune, Thane, and Nashik know your needs.

• Diverse Options: Access multiple consultants for tailored solutions.

• Trusted Platform: Built for Indian taxpayers’ success.

Why Prefer Local Tax Consultants?

Local tax consultants provide face-to-face support, unlike online or phone advisors. They simplify ITR filing, explain deductions, and craft personalized strategies, ensuring trust and accuracy.

Don’t Delay: Tax deadlines wait for no one—save big now! Visit NiveshKaro’s Contact page at www.niveshkaro.com and connect with our commission-free local experts who are 100% on your side! Get personalized tax and investment advice tailored to your financial goals, with low-cost services and real-time updates.