- 4B - 48, Fourth Floor, High Street - Highland Corporate Center, Kapurbawadi, Thane (w) 400607

- info@niveshkaro.com

Looking for a safe way to grow your money for retirement, a child’s education, or a dream home? Government Securities and Bonds offer stability and guaranteed returns, perfect for cautious Indian investors. In 2025, with rising interest in secure investments, there’s no better time to dive in! NiveshKaro.com, India’s trusted zero-commission platform, connects you with expert advisors to choose the best government bonds in India. Don’t wait—act now to lock in steady returns!

What are Government Securities & Bonds?

Government Securities (G-Secs) are debt instruments issued by the Indian government to fund projects, offering fixed interest with virtually no risk. Bonds (public or private) are similar, issued by governments or companies, paying regular interest until maturity. They’re ideal for investors in Mumbai, Pune, or Nashik seeking low-risk wealth-building.

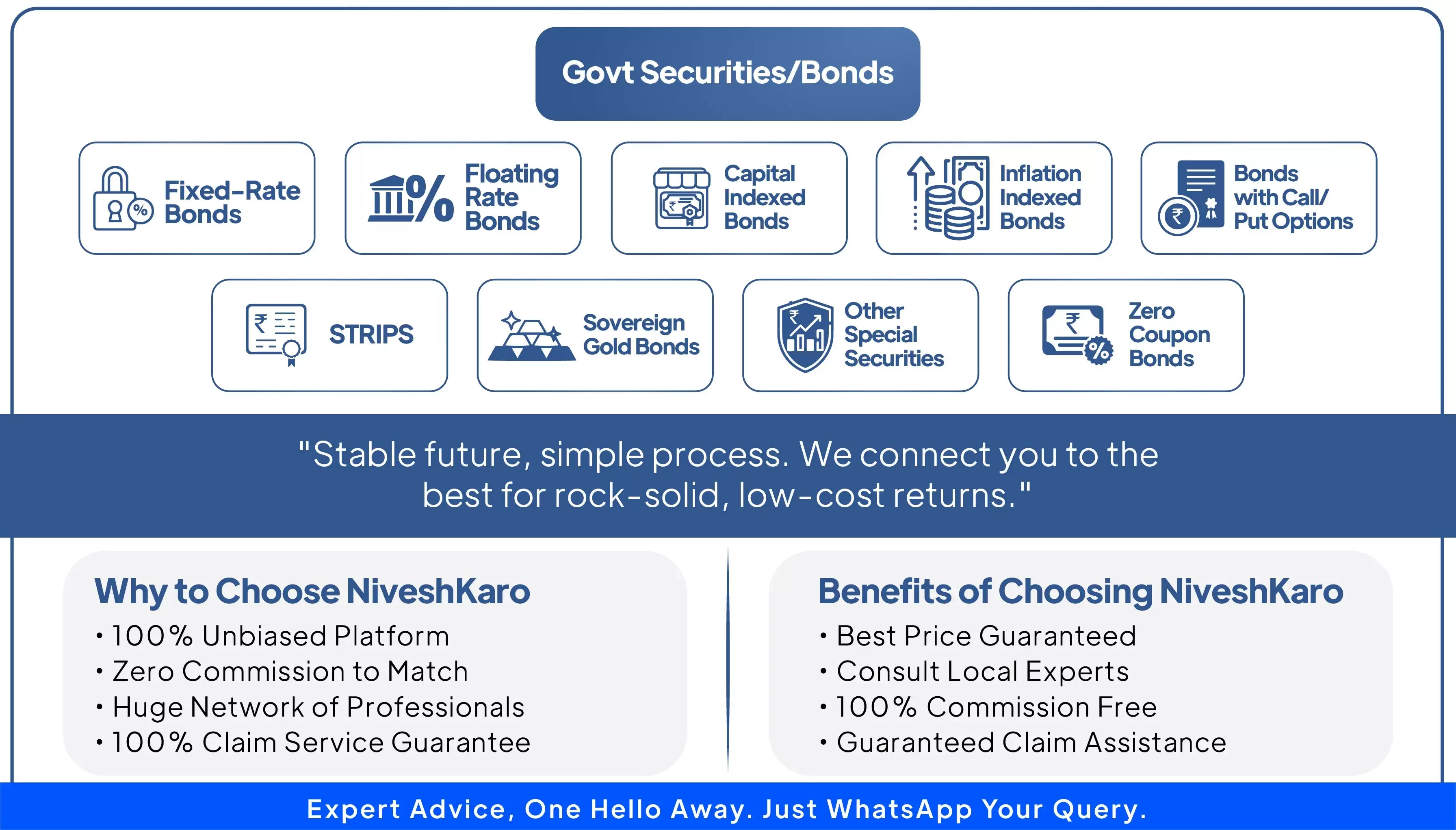

Types of Government Securities & Bonds

• Treasury Bills: Short-term G-Secs (91–364 days), no interest but discounted pricing.

• Government Bonds: Long-term securities with fixed interest (e.g., 7.1% G-Sec 2034).

• State Development Loans (SDLs): Issued by state governments, slightly higher yields.

• Corporate Bonds: Private firms’ bonds, higher returns with moderate risk.

• Tax-Free Bonds: Public sector bonds with tax-exempt interest.

Why Invest in Government Securities & Bonds?

In 2025, with India’s economy growing, G-Secs and bonds provide safety amid market volatility. They’re vital for:

• Young Professionals: Build a secure foundation.

• Families: Save for education or emergencies.

• Retirees: Ensure steady income.

Act Fast: Interest rates may shift—invest now for maximum gains!

Benefits of Government Securities & Bonds

• Guaranteed Returns: G-Secs are backed by the government, ensuring safety.

• Stable Income: Regular interest payments for cash flow.

• Tax Benefits: Tax-free bonds save on interest income.

• Low Risk: Safer than stocks, ideal for conservative investors.

• Flexibility: Short- or long-term options suit any goal.

Achieving Life Goals with G-Secs & Bonds

Use market trends like rising bond yields or green bonds and strategies like laddering (spreading investments across maturities):

• Short-Term: Treasury bills for emergency funds (1–2 years).

• Mid-Term: Corporate bonds for car or wedding savings (3–5 years).

• Long-Term: G-Secs for retirement or education (10+ years).

When and How to Invest?

Invest in government securities and bonds at every stage of life to secure your financial future. In your 20s, start with short-term Treasury bills to build savings discipline. In your 30s, as you start a family, choose tax-free bonds to fund education or home purchases. In your 40s and 50s, opt for long-term G-Secs to support retirement planning or aging parents. For seniors, bonds provide steady income to maintain lifestyle or cover healthcare. NiveshKaro’s advisors help you:

• Select Bonds: Match risk profile and goals using yield analysis.

• Invest Easily: Buy via RBI Retail Direct or brokers at low charges.

• Stay Informed: Get regular updates on bond issuances and rates.

Why Choose NiveshKaro.com’s Advisors?

NiveshKaro.com connects you with certified, authorized advisors from top firms, ensuring unbiased, need-based G-Sec and bond plans—not what advisors want to sell. They offer in-person guidance, low-cost account setup, and services like portfolio tracking at India’s best rates. With zero commissions and real-time market updates, you stay ahead of opportunities.

Benefits of Using NiveshKaro.com

• 100% Free Service: No fees, ever.

• Independent Advice: No firm bias, just your goals.

• Local Expertise: Advisors in Mumbai, Pune, Thane, and Nashik know your market.

• Diverse Options: Access multiple issuers for tailored solutions.

• Trusted Platform: Built for Indian investors’ success.

Why Prefer Local Advisors?

Local advisors provide face-to-face support, unlike online or phone consultants. They simplify bond selection, explain yield curves, and offer personalized strategies, ensuring trust and clarity.

Don’t Delay: Secure returns are slipping away—start investing now! Visit NiveshKaro’s Contact page at www.niveshkaro.com and connect with our commission-free local experts who are 100% on your side! Get personalized investment advice tailored to your financial goals, with low-cost services and real-time market insights.